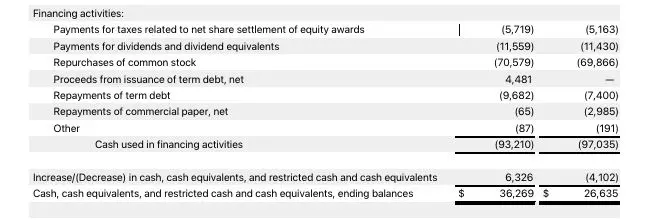

The tech giant repurchased more of its stock during this 9-month period than it did in the comparative timeframe in the previous year.

Apple (AAPL) posted its quarterly earnings this week, within which the company revealed just how much of its own stock it has been purchasing back. The Q3 2025 quarter showed Apple spent more than $70 billion on the program.

On July 31, 2025, Apple (AAPL) shared its Q3 2025 earnings results online and followed it up with a conference call. The earnings report shows it has purchased $70.5 billion of its own shares as part of its common stock buyback program over the past nine months. This is an increase compared to the same period the previous fiscal year.

In August 2025, Apple reported it had spent over $69 billion in stock buybacks over the previous nine months.

“We are very pleased with our record business performance for the June quarter, which generated EPS growth of 12 percent,” said Kevan Parekh, Apple’s CFO. “Our installed base of active devices also reached a new all-time high across all product categories and geographic segments, thanks to our very high levels of customer satisfaction and loyalty.”

Today’s report also showed Apple beat EPS and revenue expectations. At the time of the earnings release, Apple CEO Tim Cook spoke with CNBC, where he stated the company is open to M&A that “accelerates our roadmap.”

Read over our AAPL page for more news on how Apple has performed each quarter.